The Philippines has witnessed a remarkable transformation in its retail landscape over the past decade. What was once predominantly a mall-centric shopping culture has evolved into a dynamic digital marketplace where consumers increasingly turn to online platforms for their purchasing needs. This shift represents not just a change in buying habits, but a fundamental restructuring of the Filipino retail ecosystem.

The Digital Retail Revolution in the Philippines

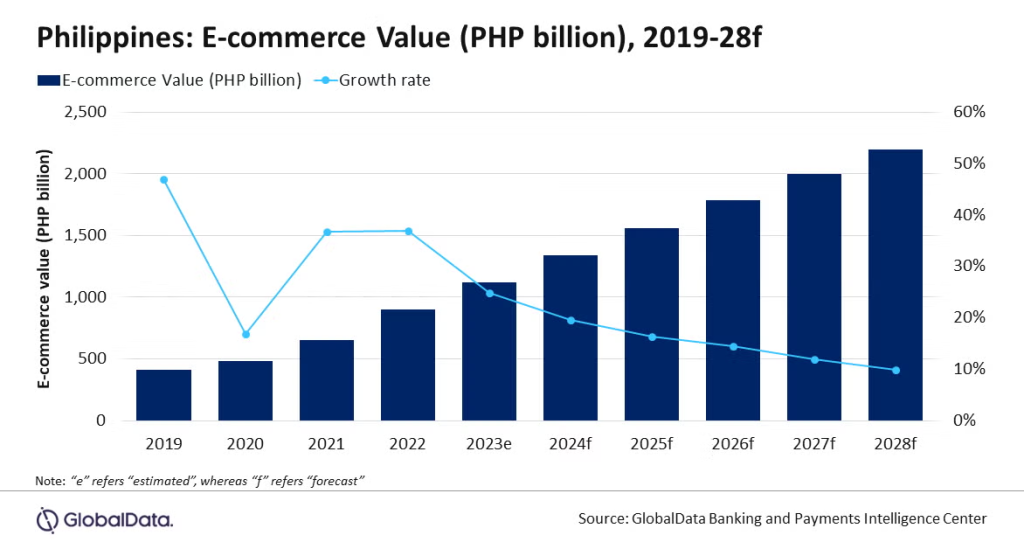

The growth of e-commerce in the Philippines has been nothing short of extraordinary. According to e-commerce statistics, the Philippine online retail market reached approximately USD 12 billion in 2022, with projections suggesting it could double by 2025. This explosive growth is driven by several key factors, including increasing internet penetration, growing smartphone usage, and a young, tech-savvy population eager to embrace digital solutions.

With over 76 million internet users and a mobile penetration rate exceeding 138%, the Philippines has established itself as one of Southeast Asia’s most promising e-commerce markets. The COVID-19 pandemic further accelerated this transition, as lockdowns and social distancing measures pushed even reluctant shoppers toward online platforms.

Key Players Shaping the Philippine E-commerce Landscape

Local and Regional Marketplaces

The Philippine online shopping scene is dominated by several key players that have successfully captured the market’s attention:

- Shopee and Lazada: These regional giants have established themselves as the go-to platforms for most Filipino online shoppers, offering everything from electronics to fashion and household items.

- Zalora: Focused primarily on fashion and lifestyle products, Zalora has carved out a significant niche in the market.

- BeautyMNL: Catering specifically to beauty and personal care products, this local platform has gained substantial popularity among Filipino consumers.

Social Commerce Boom

One of the most distinctive characteristics of Philippine e-commerce is the prominence of social commerce. Facebook, Instagram, and TikTok have evolved beyond social networking to become vibrant marketplaces where:

- Small businesses advertise and sell directly to consumers

- “Live selling” sessions attract thousands of viewers

- Community-based buying groups coordinate bulk purchases

- Direct consumer-to-consumer sales flourish

This social commerce ecosystem is particularly well-suited to Filipino culture, which places high value on personal recommendations and community connections.

Evolving Consumer Behaviors and Preferences

Mobile-First Shopping Experience

The Philippines is distinctively a mobile-first market, with approximately 97% of online shoppers making purchases through their smartphones. This has significant implications for retailers:

- Mobile-optimized websites and apps are not just preferred but essential

- Payment systems must be streamlined for small screens

- Load times and data usage efficiency are critical considerations

- Push notifications and SMS marketing yield higher engagement than email

Payment Method Evolution

The payment landscape in the Philippines continues to evolve rapidly, reflecting both technological advancement and cultural preferences:

- Cash on Delivery (COD): Remains the dominant payment method, accounting for approximately 60-70% of e-commerce transactions, according to digital marketplace growth trends. This preference reflects both consumer trust issues and the significant unbanked population.

- E-wallets: Services like GCash and PayMaya have seen exponential growth, providing convenient digital payment options even for unbanked consumers.

- Credit/Debit Cards: While usage is growing, card payments still lag behind COD and e-wallets, particularly outside major urban centers.

- Buy Now, Pay Later (BNPL): Emerging payment solutions allowing installment purchases without credit cards are gaining traction, especially among younger consumers.

Industry-Specific E-commerce Trends

Grocery and Food Delivery

Online grocery shopping and food delivery services have experienced unprecedented growth in recent years. Platforms like:

- GrabMart and GrabFood

- foodpanda

- MetroMart

- pickaroo

These services have expanded from major cities to smaller urban areas, revolutionizing how Filipinos purchase daily necessities and meals.

Electronics and Gadgets

Electronics consistently rank among the top-selling product categories on Philippine e-commerce platforms. The ability to compare prices, read reviews, and access a wider variety of brands has drawn many consumers away from traditional electronics stores.

Beauty and Personal Care

The beauty segment has witnessed remarkable online growth, with both international and local brands establishing strong digital presences. Virtual try-ons, personalized recommendations, and subscription boxes have helped overcome traditional barriers to online beauty shopping.

Challenges Facing E-commerce Growth

Despite its rapid expansion, e-commerce in the Philippines faces several significant challenges:

Logistical Hurdles

The archipelagic geography of the Philippines creates inherent logistical complexities:

- Delivery to remote islands can be costly and time-consuming

- Last-mile delivery infrastructure remains underdeveloped in many areas

- Traffic congestion in urban centers impacts delivery timelines

- Warehouse and fulfillment center networks are still expanding

Trust Issues

Building consumer trust remains a critical challenge:

- Concerns about product authenticity and quality

- Worries about personal data security

- Fear of online payment fraud

- Negative experiences with unreliable sellers

Digital Divide

While internet penetration is growing, a significant digital divide persists:

- Rural areas lag behind in connectivity and digital literacy

- Income disparities impact access to devices and data plans

- Technological barriers exclude some potential consumers

Innovative Solutions and Future Directions

The e-commerce industry in the Philippines continues to innovate in response to these challenges:

Improved Logistics Networks

Companies are investing heavily in logistics solutions:

- Micro-fulfillment centers in smaller cities

- Partnerships with local transportation networks

- Automated sorting facilities

- Drone delivery experiments for remote areas

Omnichannel Approaches

The line between online and offline retail continues to blur with:

- Click-and-collect options at physical stores

- Digital kiosks in malls and transport hubs

- QR code shopping from traditional advertising

- Online-to-offline (O2O) promotional strategies

Recommended Resources

For those interested in exploring Philippine e-commerce trends further:

- For comprehensive market data and analysis, e-commerce statistics from reputable research firms provide valuable insights into market trends and consumer behaviors.

- Understanding the broader context of digital marketplace growth can provide perspective on where the Philippines fits in the global e-commerce landscape.

- Industry reports from DTI (Department of Trade and Industry) offer local regulatory perspectives on e-commerce development.

Looking Ahead: The Future of Philippine E-commerce

As we look to the future, several trends are likely to shape the continued evolution of online shopping in the Philippines:

- Increased personalization: AI and data analytics will enable more personalized shopping experiences.

- Voice commerce: As voice assistants become more common, voice shopping is expected to grow.

- Sustainability focus: Eco-conscious consumers will drive demand for sustainable products and packaging.

- Augmented reality shopping: Virtual try-ons and AR product visualization will become more sophisticated.

- Further payment innovations: The financial technology sector will continue to evolve to meet the needs of the Philippine market.

Conclusion

The rise of online shopping in the Philippines represents a fundamental shift in consumer behavior that is reshaping the retail landscape. While challenges remain, the trajectory is clear—e-commerce will continue to grow and evolve, creating new opportunities for businesses and improving the shopping experience for Filipino consumers.

As digital infrastructure improves and more Filipinos gain access to the internet and digital payment methods, we can expect to see even more innovative approaches to online retail. Businesses that understand the unique characteristics of the Philippine market—from payment preferences to logistical considerations—will be best positioned to thrive in this dynamic environment.

FAQ About Philippine E-commerce

Q: Which online shopping platforms are most popular in the Philippines?

A: Shopee and Lazada dominate the market, with Facebook Marketplace and Instagram also serving as significant channels, especially for small businesses and direct consumer-to-consumer sales.

Q: Why is Cash on Delivery still so popular despite digital payment options?

A: COD remains popular due to a combination of factors including limited banking access for many Filipinos, concerns about online payment security, and a cultural preference for inspecting products before payment.

Q: How is mobile internet affecting e-commerce in the Philippines?

A: With over 97% of Filipino internet users accessing the web via mobile devices, m-commerce dominates the online shopping landscape. Successful platforms optimize for mobile-first experiences with easy navigation, fast loading times, and streamlined checkout processes.